ProRealTime Trading

The best of both services

in one account

Why use ProRealTime together with Interactive Brokers?

* Interactive Brokers elected "Best online broker" in 2025 by “BrokerChooser”.

** ProRealTime elected "Best trading platform" by "brokervergleich.com" in 2025 for the 8th consecutive year and "Best platform for investing" by "rankia.com" in 2025.

trading

A pleasant and efficient trading interface

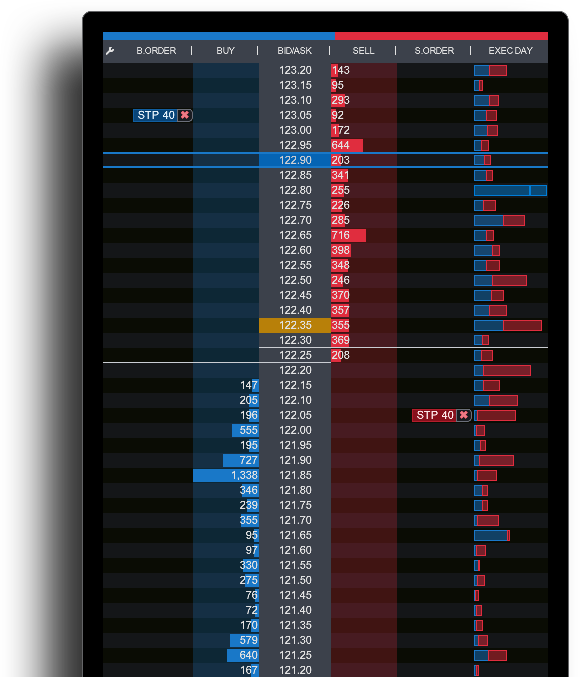

Trade from the order book

Place and manage your orders and positions directly from the order book.

Market depth and order flow

- Display up to 20 lines of market depth.

- Order Flow: See the flow of orders of other traders in real time to make predictions about short-term market movements.

Estimated position in the order book

Check the estimated position of your limit orders in the order book to understand your chances of execution on volatile or low-liquidity instruments.

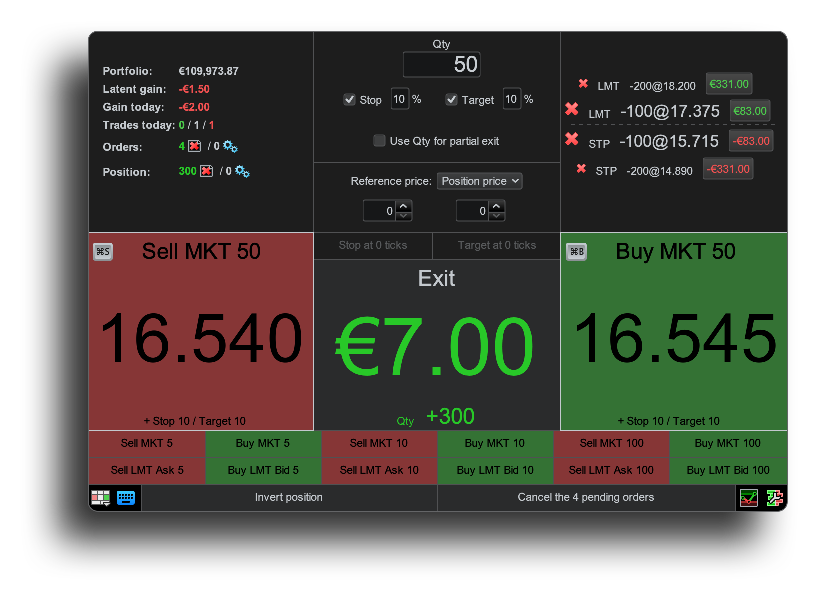

Scalping Interface

A high-speed trading interface that puts all essential information at your fingertips.

Many types of orders available

- Triple orders to automatically attach a target and a stop loss to your entry orders.

- Trailing stops to secure your gains as price moves in your favor

- Oblique orders to enter or exit on channel rebounds or breakouts

- One cancels the other (OCO)

- Automated quantity orders...

Link orders to your alerts

- Transmit your orders automatically when your alerts are triggered.

- Preset your order type, price level and attach target and stops.

- Alerts can be based on multiple conditions such as indicators, price, time …

PaperTrading & Market Replay

Once your account is open, you can start your ProRealTime platforms in either real trading mode or PaperTrading mode (virtual portfolio).

Virtual trading with PaperTrading is for all traders: it offers you a safe environment to experiment, without risking your capital.

Market replay allows you to practice using historical data, on any instrument, in any time frame, to improve your trading and analysis skills.

Detailed reports on your trading

- Fully customisable performance reports on your trading activity

- Over 30 statistics available such as performance/risk ratio, average position duration, …

Automatic trading

Automatic trading made easy

PROREALTIME TRADING

Maximize your opportunities

A brokerage service designed to give you an edge in the markets

Short selling

on all instruments*

Short selling allows you to seize opportunities for profit, even in a bear market.

ProRealTime accounts with IB allow you to invest in both long and short positions on all instruments*, including European and US stocks.

* Except for securities for which short selling is restricted or prohibited by regulations.Multi-currency account

- Your account can hold funds in multiple currencies at the same time, allowing you to save on conversion fees.

- Make deposits and withdrawals in the currency of your choice from among those supported: Euro, Dollar, Swiss Franc, Pound Sterling, etc.

- Gains made in other currencies will remain in the currency in which they were made instead of being forcibly converted into your account's base currency. This allows you to save fees by consolidating your conversions.

Fractional shares

Fractional shares let you invest in a portion of a stock, making it easier to access high-priced shares.

You can invest the exact amount you want, making it easier to diversify your portfolio even with limited capital.

Smart Routing

for better execution

Most stocks can be traded on several exchanges. At any given moment, the price of the same stock may differ from one exchange to another.

With Smart Routing, your orders are automatically sent to the exchange offering the best execution conditions at that moment.

To determine the exchange destination of an order, Interactive Brokers' smart routing takes into account several factors such as: the best bid or ask price, speed, probability of execution, size and type of your order, and execution costs.

Note that you can also disable Smart Routing if you prefer your orders to be sent only to the stock's primary exchange.

Brokerage fees

Ultra-competitive fees

United States

France

Germany

Calculation of brokerage fees with Trader pricing

| Order amount |

€2,000

|

€5,000

|

€7,500

|

€10,000

|

|---|---|---|---|---|

| Fee |

€2.95

|

€3.73

|

€5.47

|

€7.2

|

Brokerage fee calculations based on a stock order executed on Euronext using Trader pricing.

Micro DAX

Mini DAX

Micro US Futures

Other US Futures

BitcoinMicro

EtherMicro

RippleMicro

SolanaMicro

Accumulate PRT credits with each trade

Use your PRT credits to get additional free services

How it works

With the ProRealTime rewards program you gain up to 1 PRT Credit per executed order or contract. If you enable optional services on your ProRealTime account, PRT Credits are automatically used to get them for free or at a reduced price.

*on standard sized instruments, CFD and Forex excluded

What you can get with PRT Credits

You can use PRT Credits to get additional services for free or at a reduced price.

ProRealTime Complete

Upgrade to ProRealTime Complete or even to ProRealTime Premium to access more advanced features and historical data.

Additional Market Data

Access data directly from official exchanges for the most accurate, up-to-the-tick information.

Market Profile ®

Enable the “Market Profile” ® (also called “Time Price Opportunity” or “TPO”) chart style in your ProRealTime Complete or Premium platform.

Speed and reliability

Enabling you to quickly respond to market opportunities

Speed of order transmission

For faster order execution, we use dedicated ultra-low latency connections between ProRealTime, Interactive Brokers, and the exchanges.

Your orders are handled server-side whenever possible, speeding up transmission and enhancing reliability.

Fast and reliable real-time market data

Fast and high quality market data empowers you to make smart decisions and execute orders quickly.

That’s why ProRealTime invests heavily in its data feed infrastructure each year, providing you with a direct connection to the stock exchanges with no intermediaries.

Access smooth and responsive market data, even during periods of high volatility.

Financial strength

Invest with total confidence

Interactive Brokers in numbers:

Years of experience

customers worldwide

USD of client funds held in 2024

USD of consolidated capital of Interactive Brokers Group

A world-renowned broker

Interactive Brokers is regularly recognized by leading publications such as Forbes, Barron's, and Stocks & Commodities magazine.

A solid and reliable broker

Interactive Brokers has a regulatory capital surplus of $13.3 billion and manages its brokerage and market-making activities in two separate companies.

Segregated accounts

Funds in individual accounts are held in segregated client accounts that are completely separate from Interactive Brokers' assets.

They can never be used to cover any debts incurred by the company.

In addition, IB manages its brokerage and market activities in two separate companies.

Deposit guarantee

Interactive Brokers Ireland is a member of the Investor Compensation Scheme (ICS) in Ireland.

In addition, client funds are distributed among several banks, selected for their reliability. This measure provides a higher level of protection by reducing the concentration risk associated with depositing client funds with a single custodian.

Premium client service

Customer service that rises to the challenge

What our clients say

1038 independent reviews

as of 2/1/26

One thing that cannot be emphasized enough: ProRealTime works “server-side.” This means that your orders are actually stored on ProRealTime's servers and NOT on your PC. This contrasts with many other charting/trading tools that run on your PC, which is of paramount importance with automatic trading. Your trades will not be compromised if your PC crashes or you experience an Internet outage.

FAQ

Frequently asked questions

The information below is of a general nature and does not constitute investment advice or a solicitation to buy or sell financial instruments.

Account Functions & Security

If you have an account with Interactive Brokers Ireland, you can connect it to ProRealTime by following the instructions on this page.

If you have an account with another Interactive Brokers entity, the options available to you will vary depending on your country of residence.

Please contact us for more information.

When you open a ProRealTime Trading account, you are both a ProRealTime customer and an Interactive Brokers customer:

- ProRealTime, as an investment company, is responsible for receiving and transmitting your orders (RTO) submitted via the ProRealTime platforms and for communicating information from the executing broker regarding the status of your orders (executions, rejections, etc.).

- Interactive Brokers, as the executing broker, is responsible for the final execution of your orders on exchanges, as well as for maintaining your account (which includes generating your account statements, trade confirmations, margin management, corporate actions, etc.).

ProRealTime also acts as your main point of contact, assisting you with all account-related procedures and support requests.

In addition to your ProRealTime login details, you will also receive Interactive Brokers Ireland login details, allowing you to log directly into their account management interface to deposit/withdraw funds, view your account statements and trade confirmations, exercise your rights, etc.

With the “ProRealTime + Interactive Brokers” service, your funds are deposited with the account holder Interactive Brokers Ireland.

Investors often wonder about the level of guarantee for funds in the event of account holder default. While this is a legitimate question - the answer to which you will find below - it is equally important to consider other factors that contribute to a broker's reliability and soundness, in order to avoid opening an account with a player that is likely to default.

A regulated, solid, and recognized player

- Interactive Brokers Ireland is a company regulated in Ireland and therefore subject to European MiFIR and MiFID II requirements.

- Interactive Brokers serves more than 4 million clients worldwide and holds more than $781 billion in client assets in 2025.

- Interactive Brokers Group (IBG LLC) has consolidated equity of over $19.5 billion, making it one of the most capitalized retail brokers in the world with a regulatory capital surplus of $13.3 billion (figures for 2025).

- IB manages its brokerage and market activities in two separate companies.

Interactive Brokers Ireland does not make directional investments on its own behalf

Speculative proprietary trading by account holders has been the cause of two of the most significant bankruptcies in recent years.

Interactive Brokers Ireland does not make directional investments on its own behalf. Its own cash is invested in very short-term investments with a maturity of a few months, and IBKR does not hold any significant positions in OTC securities or derivatives, CDOs, MBS, or CDS.

A brokerage firm that is majority-owned by its founder

Only ~26% of Interactive Brokers' capital is listed on the stock exchanges. The remaining 74% is majority-owned by the founder, but also by his employees and subsidiaries.

Interactive Brokers highlights this significant capital investment as a guarantee of its commitment to sustainable business practices and prudent decision-making.

Margin requirements and automatic liquidations

In the recent past, exceptional market conditions have revealed the vulnerability of certain brokers who were faced with excessive indebtedness of their clients due to excessive leverage and were therefore exposed to the risk of default by some of their clients (whose accounts had a negative balance).

In order to minimize the risk of such a situation occurring as much as possible:

- Interactive Brokers sets high margin requirements for its clients and regularly reviews margins to adjust them to risks and volatility.

- Interactive Brokers continuously determines the valuation of client positions in order to identify any margin violations without delay, unlike some market participants who only perform these checks once a day at the end of the day.

- In the event of insufficient margin on a client account, Interactive Brokers will usually automatically liquidate positions on that account to end the deficit situation. This differs from some other market participants who issue margin calls, which can significantly exacerbate a client's losses before their positions are liquidated.

Segregation of funds and assets

Funds in individual accounts are held in segregated client accounts that are completely separate from Interactive Brokers' assets.

They can never be used to cover any debts incurred by the company.

Fully paid securities held by clients are kept in custody accounts and with custodians for the exclusive use of the client.

Thanks to this strict segregation of client assets, clients will be fully reimbursed in the event of default or bankruptcy of the broker. Please note that cash loans, securities loans, and positions on futures contracts are not assets belonging to clients.

Client funds are deposited in joint accounts and distributed among several reliable banks located within and outside the European Economic Area. This measure reduces the concentration risk associated with depositing client funds with a small number of banks.

Deposit guarantee

Interactive Brokers Ireland is a member of the Investor Compensation Scheme (ICS) in Ireland.

Retail clients of Interactive Brokers Ireland Limited who do not have professional status are protected by the Irish Investor Compensation Scheme (ICS). Compensation under the ICS is limited to 90% of the amount lost, up to a maximum of €20,000 per investor. The coverage provides protection in the event of the investment firm's insolvency, but not against the loss of the market value of financial products.

For more information on the ICS and answers to frequently asked questions, please visit the following website: Irish Investor Compensation Scheme

Please note that ProRealTime is a multi-broker platform that also offers the “ProRealTime + Saxo Bank” service, where the account manager – “Saxo Bank A/S” – is a member of the Danish Guarantee Fund, which offers deposit protection for private clients of up to €100,000. Some of our clients have chosen to open both a “ProRealTime + Saxo Bank A/S” and a “ProRealTime + Interactive Brokers” account.

Learn more about the “ProRealTime + Saxo Bank” serviceFees & Costs

About ProRealTime platforms

ProRealTime offers free and unlimited access to the following applications:

- ProRealTime Mobile: view prices and trade from your smartphone.

- ProRealTime Web: all the essential features of ProRealTime accessible directly in your browser.

Optionally, you can also subscribe to ProRealTime Complete, a version of ProRealTime that you can install on your computer and which offers additional features.

About data feeds

Access to real-time data is free - for an unlimited time - on:

- US Stocks*

- European stocks* (France, Germany, Belgium, Spain, Italy, UK, etc.)

- Forex

- Cryptocurrencies

- Gold & Silver Spot

*Data source: CBOE. Free access reserved for non-professional users as defined by the CBOE.

Access to real-time data on official stock/ETF exchanges, futures and options markets is available as an optional service starting at €3/month.

PRT Credits

When you place orders with ProRealTime, you accumulate “PRT Credits” that allow you to access ProRealTime Complete and optional market data for free or at a reduced rate.

Useful links:

All brokerage fees applicable to your “ProRealTime + Interactive Brokers” trading account can be found on the corresponding page Brokerage Fees on our website.

These brokerage fees are charged directly by Interactive Brokers at the time each order is executed.

Any interest will be debited once a month by Interactive Brokers.

Trading & Available Products

Leverage on stocks is available with a “margin” account.

Leverage on indices (Futures) is available on both “cash” accounts and “margin” accounts.

For more information, refer to the question: What is the difference between a “cash” account and a “margin” account?

Yes, with a ProRealTime + Interactive Brokers account, short selling is available* on a wide range of instruments, including:

- EU Stocks**

- US Stocks**

- Futures

- Cryptocurrencies (futures)

- Options

- Currencies (Forex)

- Precious metals

* Except for securities for which short selling is restricted or prohibited by regulations.

** Subject to availability of securities at the time of your transaction.

Please note, however, that short selling on certain instruments (particularly stocks) is only available with a "margin" account. For more information, see the question: What is the difference between a “cash” account and a “margin” account?

Fund Management & Taxes

Since ProRealTime + Interactive Brokers accounts are multi-currency accounts, you can deposit (or withdraw) funds in different currencies, including EUR, USD, CHF, and GBP. If you wish to deposit or withdraw funds in a currency not listed here, please contact us.

Regarding deposits/funding

Deposits can be made to your account:

- by SEPA bank transfer (euro zone) or by traditional bank wire transfer

- by transferring securities from another broker

- by internal transfer from another Interactive Brokers account

Depending on your country of residence and the currency you have selected, some payment methods may not be available.

Important: funds must be deposited exclusively from an account in the name of the account holder.

ProRealTime will send you your account number and the bank details you need to make your deposit. This information is sent to you by email from an “@prorealtime.com” address to the email address you used to create your ProRealTime account.

Regarding withdrawals

The withdrawal methods offered are the same as for deposits. The SEPA method is recommended for the euro zone. The first withdrawal of each month is free of charge for withdrawals in EUR, USD, CHF, and GBP.

Additional withdrawals are charged at €1 for SEPA transfers. For more information, see our fees page.

With the exception of the fees mentioned above, neither ProRealTime nor Interactive Brokers charge any additional fees.

You can transfer securities from your bank or broker provided that the securities in question are offered for trading by Interactive Brokers.

Please contact us for more information on the steps to take.

To fund your account by bank transfer, the transfer must be made from a standard bank account (excluding securities accounts) held in the name of the account holder.

Customer support

With ProRealTime, you benefit from our in-house customer service in multiple languages, provided by qualified representatives based in Paris, Lille, and the Netherlands.

We never use external service providers or call centers to respond to your support requests.

For general questions, a personal account manager is available to assist you. You can reach them via their direct extension number or by email to ensure efficient service and better processing of your inquiries.

With regard to order placement and execution, a team of experts continuously monitors the smooth functioning of our systems so that they can intervene proactively in the event of an incident and handle any complaints you may have with optimal responsiveness.

In the event that you make a complaint to the account holder Interactive Brokers, we will assist you in ensuring that it has the best chance of success. You are also free to contact the account holder directly.

Regarding customer support

ProRealTime provides support and acts as your main point of contact.

Specifically, you can contact ProRealTime with any questions you may have on the following topics:

- Use of our various trading platforms

- order transmission

- the Interactive Brokers* account management interface and all related features (deposits/withdrawals, trading permissions, account maintenance, account statements, etc.)

- the final execution of orders*

*For these topics, you also have the option of contacting Interactive Brokers directly via the message center in the account management interface.

Regarding complaints related to the transmission and/or execution of orders

The following document explains the procedure to follow for complaints.

In the event that you make a complaint related to the execution of an order, the ProRealTime teams will conduct an initial analysis to determine whether the follow-up to your complaint is the responsibility of ProRealTime or Interactive Brokers.

- ProRealTime will inform you whether or not it is responsible for the incident in the context of providing the RTO service. If this is the case, ProRealTime will be solely responsible for handling your complaint.

- If Interactive Brokers or the stock exchange is responsible, you can either file your complaint directly with Interactive Brokers or ask ProRealTime to forward the details of your complaint to them. In addition, we will assist you in your efforts by providing you and Interactive Brokers with all relevant information to give you the best chance of success.

Furthermore, for any claim involving a significant amount, we advise you to send your initial request directly to ProRealTime and to Interactive Brokers.

Closing a position and/or canceling a pending order

If you urgently need to close a position or cancel an order, the following page provides various solutions and useful contacts:

Other questions

Yes, you also have access to the platforms offered on interactivebrokers.ie. This includes TWS and the IBKR mobile application.